By alphacardprocess September 28, 2025

Today, millions of customers swipe or insert their cards at the pump on self-service fueling stations throughout the U.S. However, this convenience comes with greater risks. Fraudsters who install skimming devices on pay-at-the-pump terminals to capture card details and conduct unauthorized transactions are common threats to customers and merchants alike, causing losses and jeopardizing the security and reputation of both.

Tokenization and encryption are among the top two technologies that have drawn the attention of the payment industry to combat the risks. All of these tools work together to protect sensitive payment information by either converting cardholder data into worthless tokens or encoding cardholder data into an unreadable format during transmission.

At this point in time, gas stations have no choice but to use tokenization and encryption. Preventing fraudulent activity is just one of the security layers that offer a number of benefits for businesses looking to remain compliant and keep pace with industry standards, whilst providing customers with additional reassurance when it comes to self-service fueling.

Integration of tokenization and encryption in pay-at-the-pump systems create a secure fueling environment and build consumer confidence in connecting with the gas stations. Let us understand the role of tokenization and encryption for securing transactions.

Understanding Pay-at-the-Pump Risks

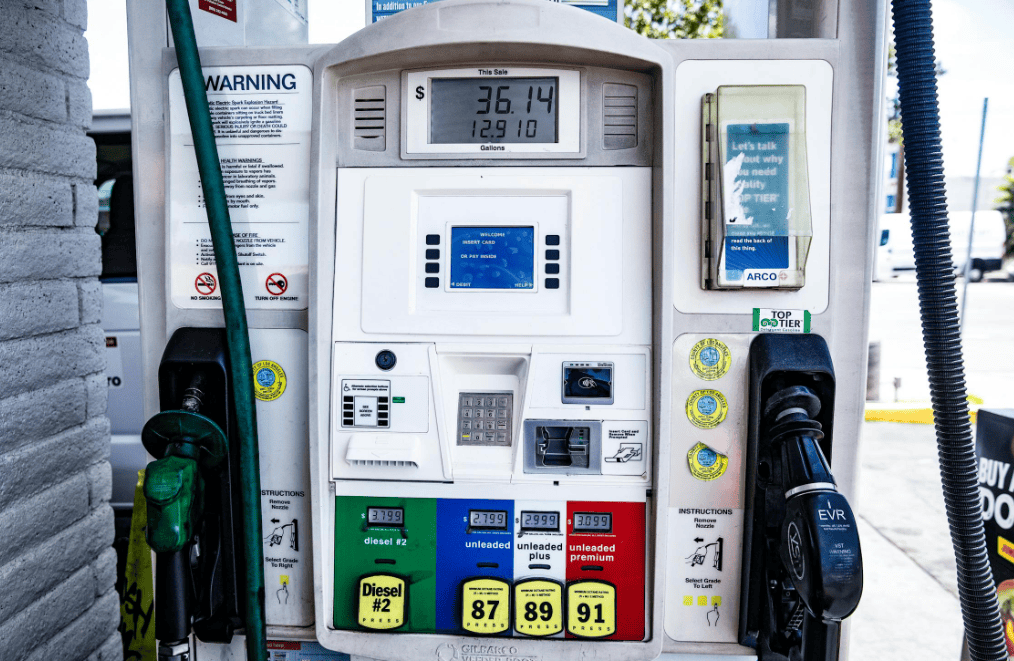

Gas stations are one of the most frequent targets of payment card fraud largely due to the insecurity of pay-at-the-pump terminals. In particular, fuel pumps are often unattended and located outside with limited supervision to detect suspicious activity, setting them apart from in-store card readers. These are some of the perfect locations for fraudsters to attach their skimming or shimming devices which help them to capture card information at point of sale without even the customer knowing.

In skimming, fraudsters attach to the card reader external device which secretly copying magnetic stripe data. Shimming — a newer method is when a thin device is implanted within the chip slot, intercepting EMV data. This information can be then used to make fake cards or to buy online.

The financial effect of these attacks can be two fold. Even customers face a challenge here as they have to deal with unauthorized charges, compromise on their identity as well as reload the disputes. At the same time, gas station operators bear the cost of chargebacks and reputational damage, as well as the risk of non-compliance if found to have insufficient security measures.

Moreover, pay-at-the-pump terminals historically lag behind in adopting new security standards. Many stations were slow to upgrade to EMV chip technology, leaving them exposed to fraud and liable for losses. Even with EMV, without robust protections like tokenization and encryption, data transmitted from the pump to the payment processor can still be intercepted.

Overall, the combination of high transaction volumes, unattended terminals, and evolving fraud techniques means pay-at-the-pump environments are vulnerable, so it is imperative to have advanced security measures in place.

What Is Tokenization?

Tokenization is a security mechanism that replaces sensitive payment card data with a unique, randomly generated identifier called a token. The actual card number is not stored or transacted at the pay-at-the-pump terminal when a customer swipes, inserts or taps their card. Instead, it gets replaced with a token that has no real end value that a criminal could exploit if they intercepted the token.

So, if someone were to hack the payment system of a gas station and access the transaction records, they would just get some messed up strings – the actual card information could not be found. The payment processor or tokenization system is the only entity that can map these tokens back to the original card information, and even then only in a secure environment.

For pay-at-the-pump, tokenization is uniquely impactful, minimizing the chances of data breaches happen. And even if fraudsters install a skimmer or somehow access a merchant’s system, the information they steal can’t be used to produce counterfeit cards or make fake purchases.

Moreover, tokenization aids gas stations and merchants with adherence to the regulations. PCI DSS stands for Payment Card Industry Data Security Standards, and it is mandatory for organizations to secure the data of the cardholder. This reduces compliance scope, enabling fuel merchants to minimize the complexity and expenses related to regulatory compliance and remove sensitive card details from the equation by using tokens instead.

In the end, tokenization makes sure that in case criminals get access to transaction systems, they have nothing to show for it. Pay-at-the-pump, where the security risk is greater — this layer of protection becomes critical to safeguarding consumers and businesses.

What Is Encryption?

Encryption is also one of the most important security methods to be deployed, protecting sensitive payment data during transaction transmission. While tokenization replaces a card number with a token, encryption scrambles the original card with complex algorithms so it is unreadable without a decryption key.

This way, when a customer does a pay-at-the-pump, the card transactions are encrypted immediately at the terminal before they even travel to the payment network. This means that if cybercriminals, for example, manage to intercept the data while it is said to be ‘in transit’, what they are presented with resembles a random string of gibberish. Only the payment processor, in possession of the proper decryption tools, can access and read the information for authorization purposes.

Two common types of encryption used in payment security are:

- Point-to-Point Encryption (P2PE): Secures card data between the point of entry at the pump up until it reaches the secure endpoint (the processor).

- Extensive or End-to-End Encryption (E2EE): A more extensive strategy that encrypts information for its whole lifecycle across all touchpoints.

Data transmitted from pay-at-the-pump terminals often travel through networks that are more susceptible to being breached, making encryption all the more essential. If not encrypted, hackers would be able to intercept card information on its way to the payment processor.

Alongside tokenization, encryption provides a double layer of protection: encryption protects the data in transit, while tokenization secures it at rest or in storage. This relationship also complements each other and thus makes it quite difficult for the criminals to exploit the payment information as even if one layer is breached, the other layer is still operational.

How Tokenization and Encryption Work Together?

Tokenization and encryption both play unique roles, but when used together, they create a strong line of defense at the pump. Encryption, for example, is like putting sensitive data in a box and locking it up only to be opened after transmission whereas tokenization is like removing sensitive data from a box and putting something in its place once it is stored or processed. By functioning in tandem, they secure cardholder data for all phases of the transaction lifecycle.

This is what the process looks like, in a normal pay-at-the-pump situation:

- Transaction Begins: A customer inserts, swipes, or taps their card at the pump.

- Encryption On-The-Go: The card data is encrypted right there at the terminal before it even leaves the pump. That is to say, even if criminals are monitoring the data in transit over the networks, they only catch scrambled, useless tracks of information.

- Tokenization: On receiving the encrypted data in the security of the payment processor, it decodes which is then substituted by a token. This is the token that will be held by the merchant, and be referenced by the merchant system whenever that transaction record or refund or loyalty program member needs to be accessed.

- Safe storage and processing: Because a token can never be reverse-engineered to return a real card number, even if hackers spy on the internal systems of the gas station, they never get any card values.

The real strength lies in this layered security approach. Encryption ensures the data cannot be stolen in transit, while tokenization ensures it cannot be stolen at rest. This dual protection significantly reduces the risks of fraud, chargebacks, and regulatory non-compliance for gas stations.

This frictionless security helps build trust in users. Their cards can be used without concern at unattended terminals, safe in the knowledge that their data cannot be skimmed or otherwise compromised. For station operators, it lowers liability, compliance costs and reputational risk — all of which are important as the fueling industry becomes more competitive.

To sum it up, tokenization and encryption balance each other and together they are the foundation of secure pay-at-the-pump transactions.

Challenges and Limitations

Tokenization and encryption is a unique solution that benefits consumers and pay-at-the-pump fuel station operators alike. Such benefits go beyond fraud mitigation to support long-term trust and operational efficiency.

Better Defense from Skimming And Hacking

The old-school skimming attack depends on the collection of actual card data. This encryption means that data cannot be read in transit, while tokenization makes it so that any transaction data saved cannot be exploited by criminals at all. Combined, they reduce the risk of card-present fraud exponentially.

Reduced Compliance Burden

Gas stations must adhere to PCI DSS requirements. By leveraging tokenization, merchants avoid storing sensitive card details altogether, which reduces the scope of compliance audits. This lowers costs and makes ongoing compliance management simpler.

Improved Customer Confidence

Consumers can feel more at ease utilizing pay-at-the-pump services when they know a station employs sophisticated safeguards such as encryption and tokenization. And this trust creates loyal customers who will repeatedly visit.

Reduced Chargeback and Disputes Risk

Chargebacks are usually a result of fraud, and they cost merchants a lot of money, plus they ruin relationships with payment networks. A trustable system minimizes fraudulent disputes and ensures operators avoid revenue losses as well as reputational damage.

Future-Readiness in Payment Technology

Where digital wallets, contactless payments, and mobile apps gain acceptance at the fueling stations, encryption and tokenization provide compatibility across the payment technology spectrum. They provide the foundation of a scalable security foundation that can grow with evolving trends.

Challenges and Limitations of Tokenization & Encryption for Pay-at-the-Pump Transactions

While tokenization and encryption offer concrete benefits for pay-at-the-pump security, they also have their challenges. Being aware of these limitations enables the operators of gas stations and payment providers to formulate realistic strategies.

Implementation Costs

Typically, upgrading fuel pumps to embrace the encryption and tokenization capabilities that protect cardholder data, or redesigning pumps to mitigate risk, requires capital expenditures for software, hardware and compliance certifications. Costs can be a significant impediment for smaller, independent stations.

Complex Integration

Certainly not all legacy pump systems are suitable for advanced encryption or tokenization solutions. Some of these technologies can be tightly integrated requiring custom development or an upgrade to legacy terminals, which can slow adoption.

Ongoing Maintenance

You need a constant process to manage, rotate and secure your encryption keys. Tokenizing systems require oversight to guarantee tokens correctly map to transactions. Vulnerabilities can break into the system without regular maintenance.

Partial Protection

It’s important to note that encryption and tokenization don’t solve every fraud risk. For example, criminals may still attempt social engineering, account takeovers, or phishing attacks to exploit customers or employees. Physical tampering of pumps is also a risk that requires additional monitoring.

Dependence on Processors and Vendors

As encryption and tokenization are dependent on secure payment ecosystems, fuel merchants must rely on their payment processors and vendors to remain compliant as well as update systems to keep pace with emerging threats.

Of course, there will be challenges along the way but the benefits far exceed the cons. Though implementation has an upfront cost and effort associated with it, the long-term security, compliance, and consumer trust provided by encryption and tokenization make it a must for the future of pay-at-the-pump transactions.

Conclusion

As fuel stations continue to embrace self-service, ensuring secure pay-at-the-pump transactions has never been more important. With the rise of fraud techniques like skimming and shimming, customers and businesses alike face growing risks when sensitive payment data is left unprotected.

This is where tokenization and encryption step in as complementary security measures. Encryption protects data while it’s moving through the payment network, while tokenization ensures stored or reused transaction data is meaningless to criminals. Together, they form a dual-layer defense that significantly reduces fraud, limits chargebacks, and strengthens consumer trust.

For fuel merchants, investing in these technologies is more than just a security upgrade—it’s a business strategy. Beyond compliance with PCI DSS standards, encryption and tokenization improve efficiency, reduce liability, and foster stronger relationships with customers.

In today’s competitive environment, customers want speed and convenience but will not compromise on security. By adopting tokenization and encryption, gas stations can deliver both, ensuring their pay-at-the-pump systems are not only modern but also resilient against fraud.

FAQs

1. Why are pay-at-the-pump systems more vulnerable to fraud?

Because they are unattended and outdoors, criminals can easily install skimmers or shimmers without detection, making them prime targets for fraud.

2. How does tokenization protect my card at the pump?

Tokenization replaces your actual card number with a random token. Even if criminals steal this token, it has no value outside the secure payment system.

3. What’s the difference between encryption and tokenization?

Encryption scrambles data in transit so it’s unreadable if intercepted. Tokenization replaces stored card data with a useless identifier, protecting it at rest.

4. Do all gas stations use tokenization and encryption today?

Not all. While many large chains have upgraded, some smaller or older stations may still run outdated systems without these protections.

5. Is EMV alone enough to protect pay-at-the-pump transactions?

No. EMV chip cards prevent counterfeit fraud but don’t secure data in transmission or storage. Tokenization and encryption are necessary for full protection.